PA Charity Registration Exemption Form

- By -

- Uncategorized

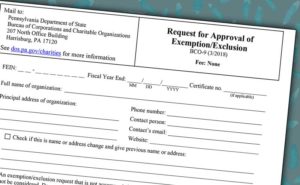

PA NEW EXEPTION/EXCLUSION REQUEST FORM

PA NEW EXEPTION/EXCLUSION REQUEST FORM

Did you know that Pennsylvania now has a form to request exemption/exclusion from state charity registration? In the past, nonprofit organizations detailed in Solicitation of Funds for Charitable Purposes Act under 10 P.S. § 162.6 or excluded from the Act under 10 P.S. § 162.3 could self-certify with no requirement to file a form with the PA Bureau of Corporations and Charitable Organizations to claim exempt status.

Now, PA FORM BCO-9, Request for Approval of Exemption/Exclusion, provides nonprofit organizations with the information required to determine whether the nonprofit is exempt and if exempt, the documentation required to secure approval. PA has conveniently included an easy-to-read chart – check it out at:

EXEMPT VS EXCLUDED

If an organization is exempt from registration requirements, it must still comply with the other provisions of the Solicitation of Funds for Charitable Purposes Act (e.g. must keep true fiscal records as to its activities; may not utilize any unfair or deceptive acts or practices or engage in any fraudulent conduct which creates a likelihood of confusion or of misunderstanding, etc.). If a charitable organization is excluded under the definition of charitable organization, the excluded organization is not considered to be a charitable organization under the Act and none of the provisions of the Solicitation of Funds for Charitable Purposes Act applies to that organization.

In general, EXCLUDED organizations include religious organizations, law enforcement, firefighters, or other groups that protect public safety.

The EXEMPT list is more extensive and includes educational institutions and their supporting foundations, auxiliaries, associations, that are directly and substantially controlled by the educational institution, parent-teacher associations, hospitals and their foundation, federally chartered Veterans’ organizations, public nonprofit library organizations, senior citizen centers, nursing homes, corporations established by an act of Congress, and any nonprofit organization that receives less than $25,000 annually in gross national contributions.

WHAT HAPPENS?

If your nonprofit organizations have not either registered or completed the PA Request for Approval of Exemption/Exclusion and have engaged a Professional Fundraiser – get ready to hear from PA! When the PFR files a required campaign notice, a letter will be generated notifying the charity that they must either register or apply for an exemption. No services can be provided by the PFR until the charity is registered.